ACA Reporting Software That Anticipates

Year after year, change is inevitable. But it’s hard to keep track of every rule change, every year. As a requirement, all employers under the Affordable Care Act must report their IRS health benefits statements. Luckily for you, to give you peace of mind, our ACA compliance software allows you to stay ahead of the game with compliance that anticipates. At Viventium, our goal is simple: help you simplify reporting and avoid potential risks or costly penalties.

The Top Five Things Your ACA Compliant Payroll Software Will Do

- Determine full- and part-time status for each employee

- Track employees’ offers, enrollments, and waivers during initial, ongoing, administrative, and stability periods

- Alert you to ACA penalty exposure for missing and unaffordable offers

- Maintain benefit plan information with employee costs and archive minimum essential and minimum value data for fighting proposed penalties

- Produce year-end ACA forms, including Series 1 and 2 codes, and file them electronically

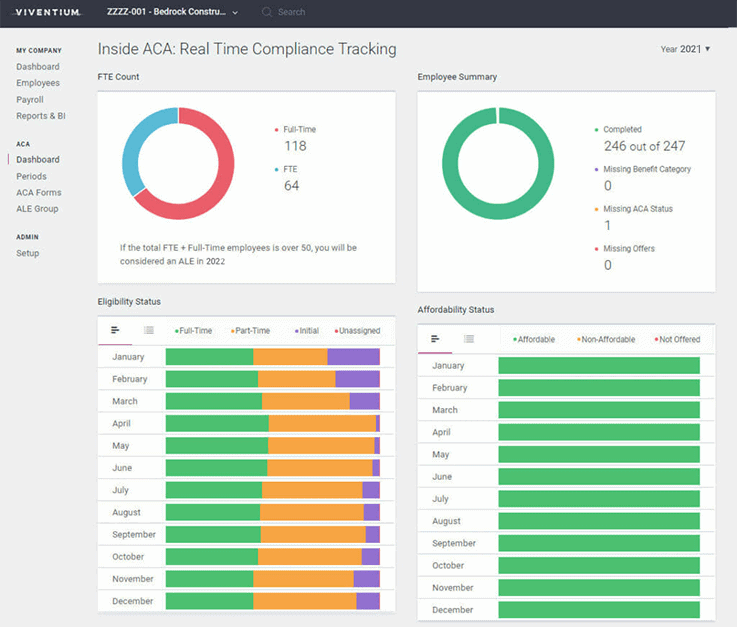

Dashboard

| Ensure your compliance at all times with a quick glance at the dashboard

| Check on your ALE status with this count of full-time equivalent employees

| Choose a visual bar graph or a numerical breakdown – whichever way you want to see your data

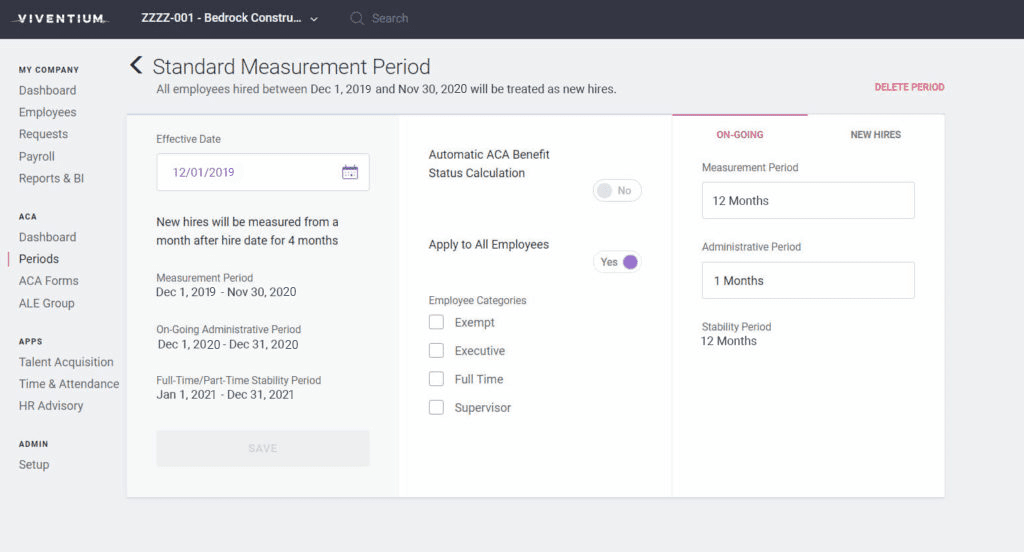

STANDARD MEASUREMENT PERIOD

| Get real-time updates on full-time and part-time statuses of your employees

| Check our automatically generated list of your employees who might have changes to their status

| Make changes manually, or let our smart system change your employee’s status for you

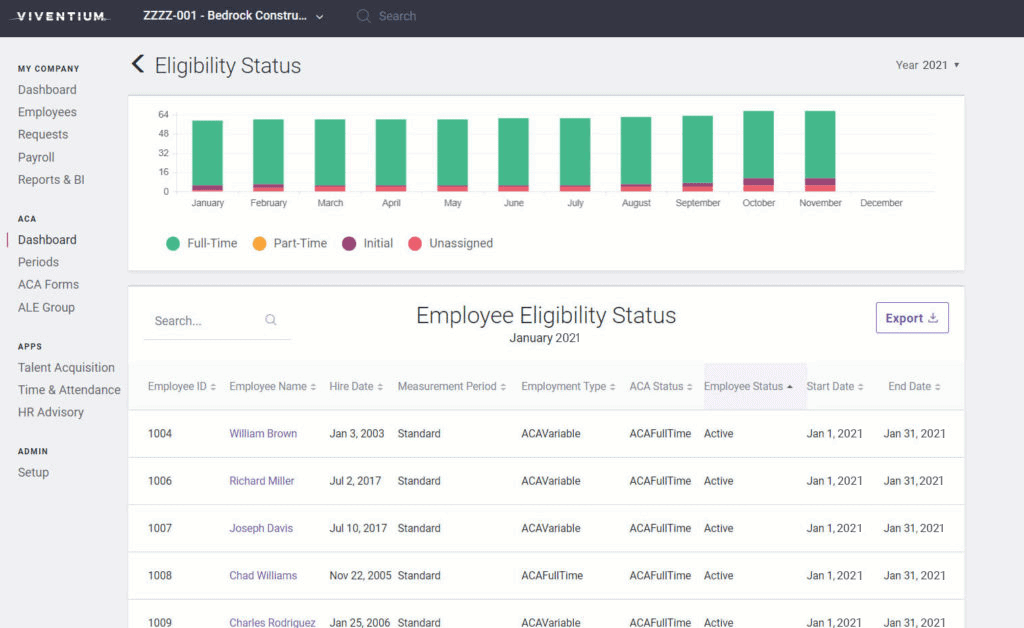

ELIGIBILITY STATUS

| Click on a widget to drill down into the data behind the visuals

| Get even more details by clicking on each month

| See exactly which employees are behind the numbers and access their profiles

The Evolution of ACA Compliance: Then and Now

2015

The lookback period to determine ALE status for 2015 can be anywhere between 6-12 consecutive months in 2014.

Employers with 100 or more full-time and full-time equivalent employees must offer health insurance to full-time employees.

ALEs must offer coverage to the employee but not dependents if dependents had not been previously offered coverage and the employer takes steps in 2015 towards offering dependent coverage.

ALEs must offer coverage to at least 70% of full-time employees in order to avoid the 4980H(a) sledgehammer penalty.

ALEs subject to the 4980H(a) penalty can disregard their first 80 full-time employees when calculating the penalty.

The amount of the 4980H(a) penalty is $2,080 per employee per year.

The amount of the 4980H(b) penalty is $3,120 per employee per year.

The 2015 Affordability Safe Harbor rate is 9.56%.

2024

The lookback period to determine ALE status for 2024 and all future years is the full 12 months of the prior year.

Employers with 50 or more full-time and full-time equivalent employees must offer health insurance to full-time employees.

ALEs must offer coverage to the employee and their dependents up to age 26.

ALEs must offer coverage to at least 95% of full-time employees in order to avoid the 4980H(a) sledgehammer penalty.

ALEs subject to the 4980H(a) sledgehammer penalty can disregard their first 30 full-time employees when calculating the penalty.

The amount of the 4980H(a) penalty is $2,970 per employee per year.

The amount of the 4980H(b) penalty is $4,460 per employee per year.

In 2017, a conditional offer of insurance to a spouse must be reported separately.

The 2024 Affordability Safe Harbor rate is 8.39%

ICHRA offers of coverage reported on 1095-C.

Viventium is dedicated to keeping you informed of the latest payroll developments and assisting you with understanding the ever-increasing

government regulations. This information is not intended as tax or legal advice. We encourage our readers to consult their tax and law advisors.

Does the Affordable Care Act Affect You in 2024?

For the year 2024, employers with 50 or more full-time employees or equivalents must offer health coverage to full-time employees and file Forms 1094-C and 1095-C with the IRS. Filings are due to the IRS in the first quarter of 2025, and a copy of the 1095-C must be distributed to each employee by March 3, 2025.

Employers who fail to offer health coverage and file Forms 1094-C and 1095-C may be subject to IRS penalties.

State health care reporting is on the rise as an increasing number of states require an employer to report their ACA information on the state level.

Relax. We’re on top of it, and if you are on our service, we’ve got you covered with the latest ACA requirements. We’ll keep you informed on the latest state health care reporting requirements and how you can maintain compliance.

Are You an Applicable Large Employer (ALE) in 2024?

To determine ALE status during the current year, employers use a lookback period during the prior year. If an employer has on average 50 or more full-time employees, including full-time equivalents, during the 2023 lookback period, the employer is an ALE for 2024.

Learn more about the Affordable Care Act by visiting our ACA FAQ page.

Compliance That Anticipates

Viventium’s ACA reporting software helps you stay compliant by delivering live ACA data throughout 2024. At the beginning of 2025, Viventium will prepare and file Forms 1094-C and 1095-C on your behalf.

Viventium’s ACA Compliance Software:

Our software calculates full-time and full-time equivalents to determine applicable large employer (ALE) status

Provides a preview of Forms 1094-C and 1095-C to review and approve before production

Alerts you to any missing or unaffordable offers

Calculates and tracks full-time or part-time status of each employee including variable employees to determine who must be offered health coverage

Tracks offers of coverage and affordability on a month-by-month basis

Produces Form 1095-C employee copies and e-files Forms 1094-C and 1095-C with the IRS